Highlights

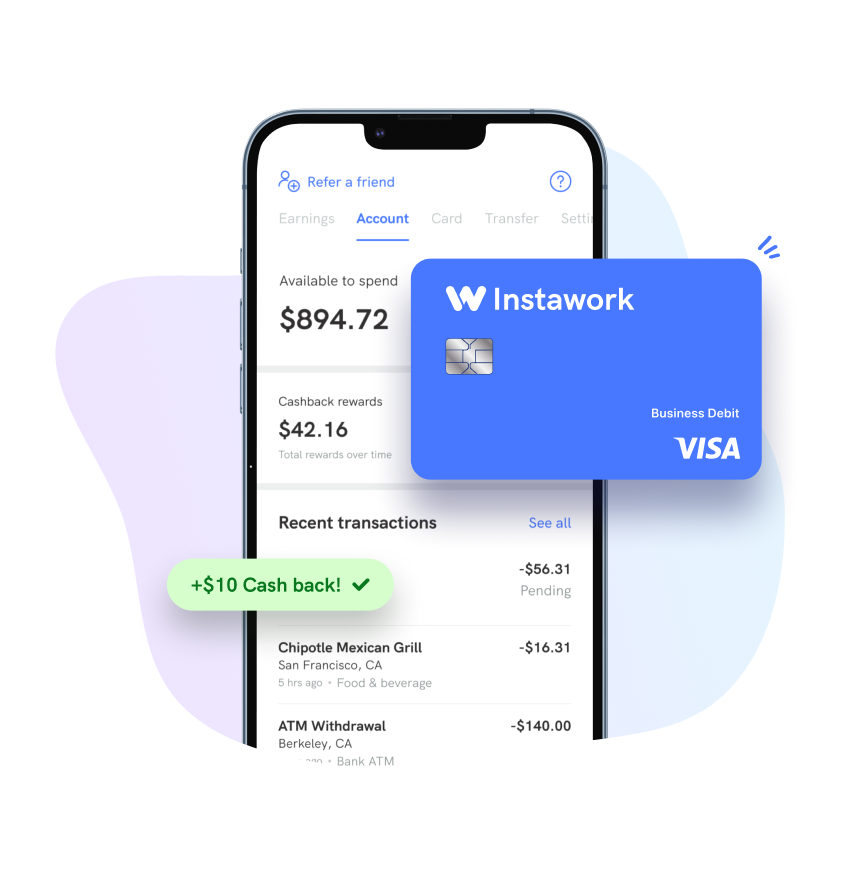

Instant Payments

Get your earnings instantly deposited to your Instawork Card after each shift. No waiting, no fees for instant payment.1

Up to 5% Cash Back

5% cash back on gas and public transit for Platinum Pros; all other Pros get 2% cash back.2

No ATM Fees

Withdraw cash at over 55,000 no-fee ATMs. No low-balance or maintenance fees.3

Features

Debit card and checking account

-

Your money

Manage your money right from the Instawork app. No need to download another app. -

Your card

Use your card to make purchases online and in stores anywhere Visa is accepted.

Account Security

-

Fraud Prevention

Lock your card at any time in the Instawork App. -

Deposit Insurance

Have peace of mind with $250,000 of FDIC insurance through our bank partner.

Apply to get your card

Frequently Asked Questions

What is the Instawork Card?

The Instawork Card is a business VISA debit card and a checking account designed just for flexible workers to help you get paid instantly after clock out and earn up to 5% cash back on gas and public transit. You can use it everywhere Visa is accepted.

Is Instawork a bank?

Instawork is not a bank. The Instawork Card is offered through Piermont Bank, Member FDIC. With the Instawork Card, you can withdraw cash at 55,000 no-fee ATMs in the AllPoint network.

Is this a debit or credit card?

The Instawork Card is a debit card and a checking account.

Why is Instawork Card a business debit card?

As an Instawork Pro, you run your own business. Visa’s business network is set up for contractors like you.

Will this impact my credit?

There will be no credit check required to apply for and use the Instawork Card.